Two times as of numerous payday loan recipients focus on Walmart compared to the following common business, Kaiser

Payday loans can be used from the individuals who you want currency prompt, which normally have no alternative way off credit money to pay for an urgent expenses. The benefit of these types of funds is that they permit you to meet up with your own quick bills. The risk, however, is you is actually taking on loans and you will incurring future loans one to need future income to meet up with.

In this post, we shall analyze the employment position of people who deal with pay day fund. Carry out he’s operate that will enable these to pay back the latest financing in due time otherwise will they be cornering on their own into the some debt without having any income to ever pay back the fresh financing?

At LendUp, we offer fund to those to fund unforeseen costs otherwise whenever needed the money fast. Due to the many years of underwriting funds and working with our users, we know a lot regarding economic records of one’s mortgage readers.

Inside data, we shall feedback the knowledge on work characteristics out of Us citizens exactly who seek out payday loan. Just how many people that turn-to payday loans provides services? Are they functioning full-some time and where would they work?

I unearthed that the challenging most pay day loan readers (81.2%) keeps fulltime services. After you add the amount of readers that actually work area-day or already are resigned, you to makes up about more than ninety% regarding readers. Most commonly, pay day loan users are employed in transformation, work environment, and you can health care assistance. The best workplace of LendUp pages just who find a pay day financing is actually Walmart, followed closely by Kaiser, Address and you can Household Depot.

As part of our loan application process, we ask consumers to state their a position standing and latest boss. Because of it studies, i analyzed funds out-of 2017 so you’re able to 2020 to see the most prominent employment standing, areas and companies. The information is off states in which LendUp already operates (WI, MO, Texas, La, MS, TN, CA) as well as even more claims in which i prior to now generated finance (IL, visit this web-site KS, La, MN, Okay, Or, WA, WY). When it comes to the most popular companies away from payday loan recipients, this data set often mirror the most significant companies within our largest places, eg California.

81.2% of all of the pay day loan receiver for the LendUp have complete-date a position, which means that they need to features earnings coming to pay their bills. Generally, anybody play with pay day loan to pay for timing mismatch of obtaining an expense to arrive up until the salary will come to pay for it. For many who put individuals who try area-date operating, retired, otherwise notice-employed to those with complete-date work, your account for 96.1% of pay day loan receiver. Only 1.2% away from cash advance users are classified as unemployed.

To begin with, let’s look at the work updates of individuals who get payday money thru LendUp

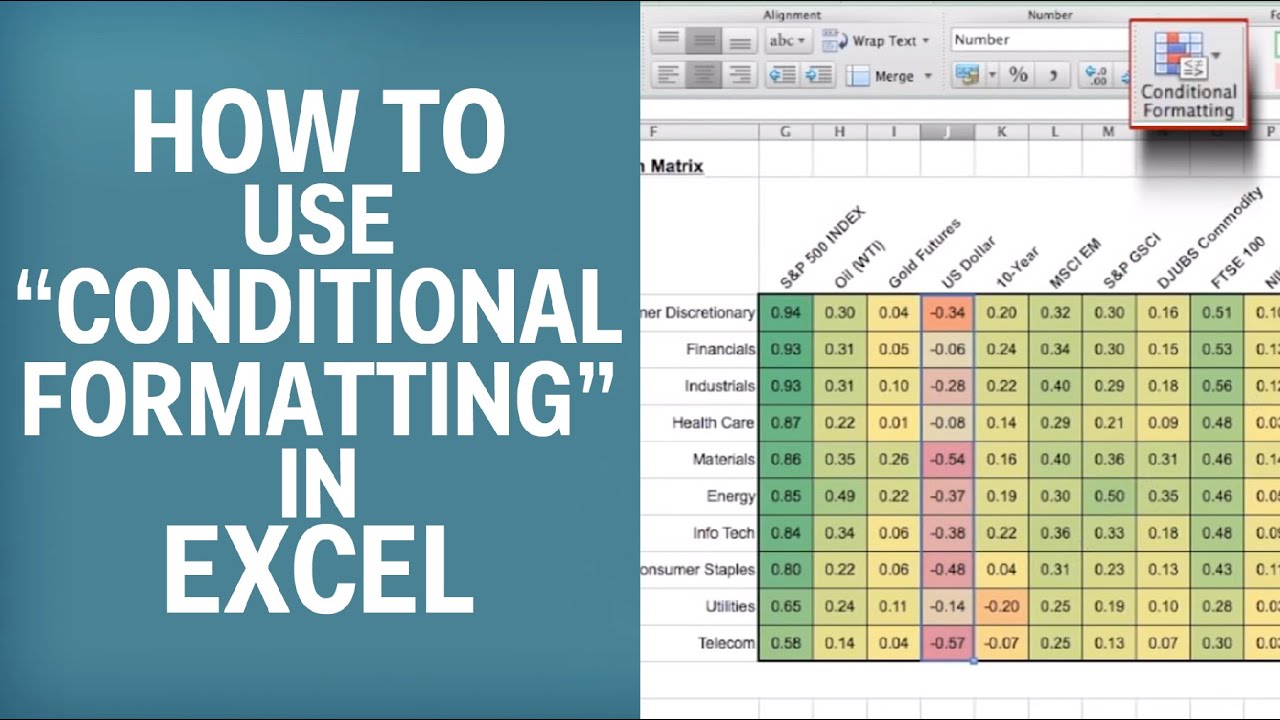

Within all of our app processes, LendUp pay day loan users report information on the community off a career. The following chart reduces financing readers from the business:

The most used world having trying to find a quick payday loan is actually sales related. This may is merchandising workers otherwise telemarketers doing good payment that have an unpredictable spend plan. Another popular marketplace is people in workplace and management. Off note, the third common classification is actually healthcare relevant.

Finally, why don’t we look at the organizations with payday loan receiver. As stated past, just remember that , this data reflects the use legs for the areas where LendUp operates and that including large businesses will naturally appear more frequently towards the lower than list:

Walmart, the largest company in the usa, ‘s the matter boss regarding payday loan receiver by way of LendUp. Record is controlled from the merchandising people, also health care, knowledge, and you may regulators.

Inside research, we’ve revealed that bulk out of cash advance recipients try operating full-time. Even after getting a routine income, costs arise that people don’t have the family savings balance to pay for. All of these someone are employed in university, hospitals, as well as the places having provided important services on pandemic. Anyone get cash advance to pay for immediate costs, and of numerous People in america, these on the internet fund will be only way to obtain funding readily available throughout the days of disaster otherwise whenever economic needs exceed offered finance.