Reduced Upwards-Front Prices: Amajor benefit of an effective HELOC over an elementary mortgage in an excellent refinancing was a lowered initial rates. Towards the a good $150,000 important financing, closing costs may include $2,000 to $5,000, except if the latest borrower will pay mortgage sufficient towards lender to blow particular or everything. With the a good $150,000 personal line of credit, costs rarely exceed $step 1,000 and in some cases was repaid of the lender instead a performance changes.

Large Contact with Interest Risk: The big downside of HELOC try its connection with attract speed chance. All of the HELOCs are variable rates mortgages (ARMs), but they are far riskier than just important Hands. Changes in industry feeling a great HELOC very quickly. When your best speed change for the April 29, new HELOC rates will vary energetic May step one. An exception to this rule are HELOCs having a guaranteed introductory rates, however these keep for just a couple months. Standard Hands, on the other hand, come having initially fixed-rates attacks as long as 10 years.

HELOC cost is associated with the prime price, and therefore certain dispute is more steady as compared to indexes employed by standard Palms. In the 2003, this yes seemed to be your situation, given that perfect rates changed only once, so you can 4% towards , the top rates altered eleven minutes and ranged between cuatro.75% and nine%. For the 1980, they altered 38 minutes and you can varied between % and you can 20%.

This new Margin: The latest crucial feature away from a good HELOC that’s not an equivalent in one financial to a different, and you will that should be the major focus off sount which is added to the top rates to choose the HELOC rates

Additionally, extremely practical Fingers keeps rate improvement hats, and that limit the size of people rate changes. And they’ve got limitation cost 5%-6% over the very first pricing, which in 2003 place them more or less during the 8% so you can 11%. HELOCs have no modifications limits, together with restriction rate is 18% except into the North carolina, where it is 16%.

Looking for a good HELOC: Wanting good HELOC is easier than just shopping for an elementary home loan, once you learn what you are really doing.

The interest rate towards the most of the HELOCs is tied to brand new finest rates, because claimed on the Wall structure Street Journal. In contrast, fundamental Arms use a number of different spiders (Libor, COFI, CODI, and the like) and this cautious buyers need certainly to view.

The rate on HELOCs to improve the original day’s the latest month after the a change in the top rates, and this can be but a few days. (Conditions are those HELOCs with an introductory secured rates, but these keep simply for that six months.) Important Fingers, on the other hand, develop the rate initially to have episodes anywhere between good times so you can ten years.

Three months afterwards, the prime rate had been 4%, nevertheless price into his mortgage was raised so you can 9

This new HELOCs don’t have any maximum toward sized a performance changes, and more than of them enjoys a maximum speed away from 18% except from inside the North carolina, where its sixteen%. Fundamental Hands could have some other rate variations hats and various limitation prices.

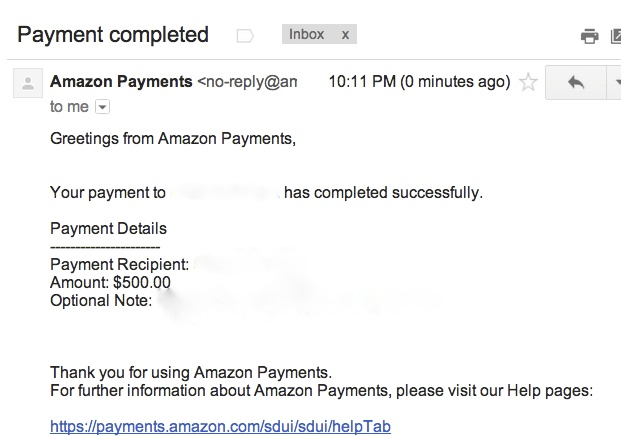

Here is what can take place once you don’t ask. Borrower X payday loans online Iowa, which gave me their record, try given a basic rates of cuatro.5% for three months. He was advised that whenever the three days the interest rate could well be according to the perfect rate. During the time the loan finalized, the prime speed is cuatro%. 5%. It turned out that the margin, that your borrower never asked about, was 5.5%!