What exactly are Closing costs?

Just what are we purchasing exactly throughout these costs? What makes they requisite, and exactly how do we have them as little as you can?

Settlement costs get into step 1 of cuatro categories: Bank Fees, Taxation & Govt. Charge, third-party Fees (instance Appraisers and you may Title people), and you can Pre-paids (like home insurance and you may possessions taxation).

Which clips have a tendency to falter just how every one of men and women works, as well as how Adjustments shall be maximized and you will/or negotiated to keep your will set you back lower.

step 3 Doorways: Old-fashioned, AIO, otherwise AIO+?

All in one try a no brainer for some residents, yet , many times clients are kept clueless about this an an option. The fresh standard alternative-a 30yr repaired loan-is the better some people can be be eligible for, however when you learn how much money you could potentially save your self (inside attention charges), your almost certainly can’t actually believe for the last. But that’s just the beginning.

Contained in this films Aaron teaches you the way to internet $step one,000,000+ (on good $450,000 loan!) when you’re smart into the All-in-one. It’s Doorway #3. And it’s really the entranceway you need!

What about Build Fund?

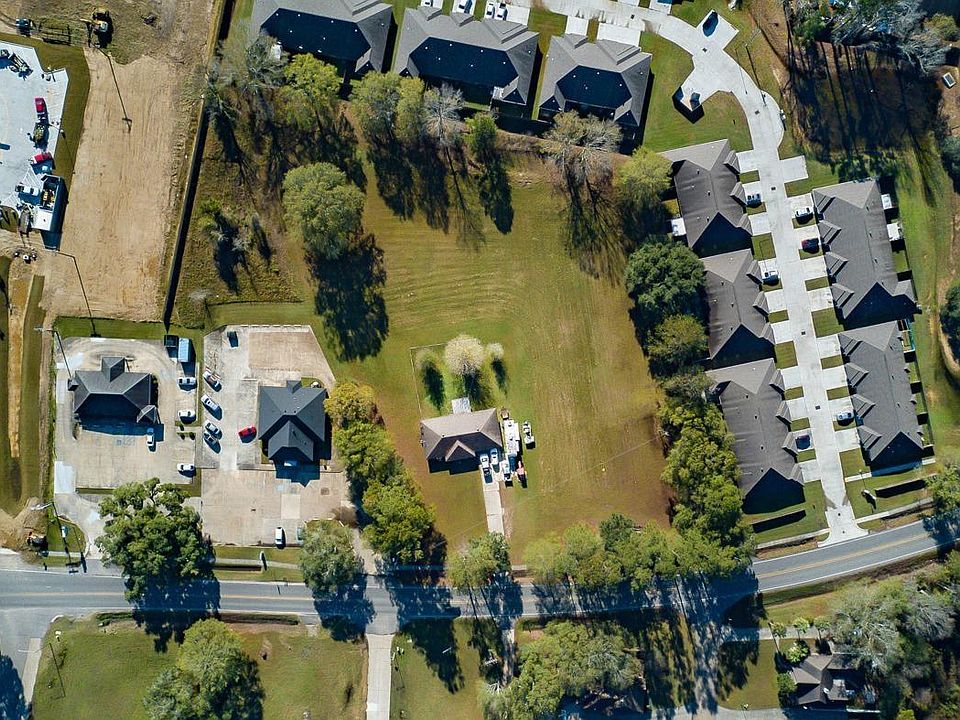

Our very own design loan coordinated up with an all in one place you besides one race-by the a mile. There is step 3 choices for you for build finance: One-go out intimate, repaired speed; One-date romantic, ARM; or A few-time personal.

Since the majority of your clients are selecting getting into AIO as fast as possible, might like a two-day intimate. It means you have a housing loan that you spend focus-merely to your during the time of construction (like any of your almost every other design financing), however, during the time of conclusion you’ll be able to in fact refinance one to your a permanent mortgage that you choose. The one-time possibilities don’t need a good re-finance, and also don’t let having transformation towards AIO.

When you need to create Design towards the All-in-one, you must have both-go out romantic. Just like the we can perform Vacant Property, The Build, as well as in a single (all-in-house), we could make this processes smooth and easy, only requiring a number of updated data files during this new re-finance to relieve people be concerned otherwise headache which could normally accompany closing toward a unique financing.

Like any other get otherwise refinance, discover normal settlement costs for the an enthusiastic AIO Mortgage. There are some even more costs (up to $dos,000), and there’s an excellent $65 yearly commission to replenish the brand new personal line of credit, just like installment loans online in Hawai there would be on the another HELOC, you to definitely initiate another year.

So you can offset it costs, i waive most of the origination charge toward AIO financing. As home financing lender, we could do this. (Note: Brokers are not.)

Other than these fees, there aren’t any unique or extra costs for a keen AIO financing compared to the a traditional mortgage.

Note: Toward an enthusiastic AIO refinance, settlement costs can go on this new loan, requiring $0 bucks to close off quite often.

What is the interest?

The pace* try a mix of one or two wide variety: 1) a beneficial margin of your preference (of numerous subscribers get a hold of step three.75%* because it will set you back no disregard issues; which margin can be bought down if you would like) + 2) a collection-i utilize the step 1 Yr Ongoing Maturity Treasury.

Inside the ‘s the reason AIO loan interest rate was 3.80% (step three.5% + 0.3%) in most mans circumstances. For folks who refinanced with the AIO mortgage and you may purchased along the margin to three%, your speed within the February should’ve become step three.30%, except-it could need to go up to 3.75% because that is the floors into the AIO financing; your rates cannot feel lower than the floor, even if the margin + list add to several lower than the ground.