You’ve shielded a loan and found the place to find their fantasies. Now you have to get ready for another line-of-your-chair minute in the home to find techniques: closure. The top question is: How long will it take to personal on property?

Closure towards the home financing might be simple, it may also render along certain curveballs which can be anxiety-causing. Like most part of the house-buying techniques, becoming waiting and you can being aware what you may anticipate might help remain shocks from increasing. There are numerous things one effect how long it entails so you can close to the home financing.

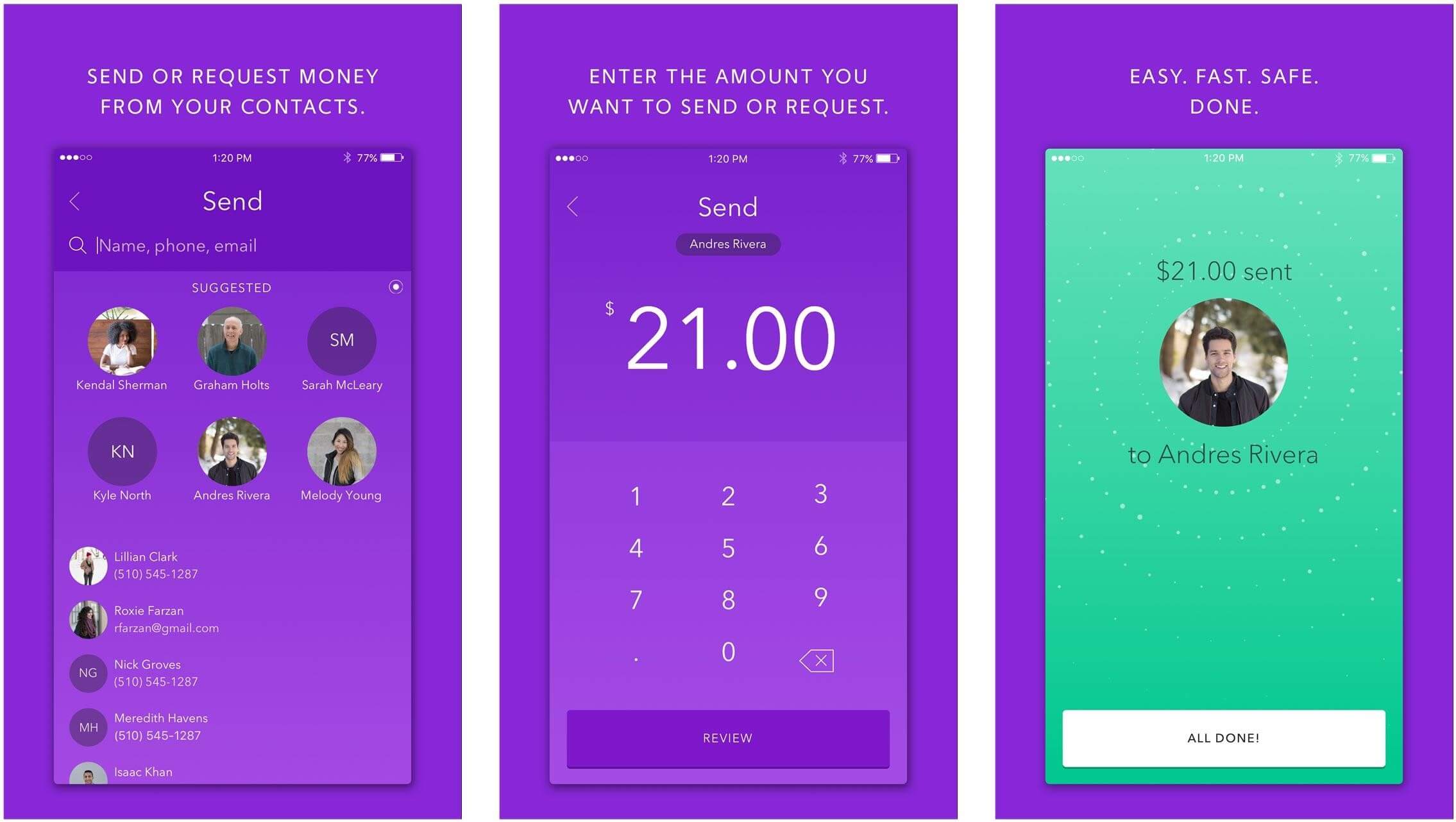

Laws can always prohibit the full payment techniques away from becoming handled electronically, so that your lender will likely features crossbreed solutions if they keeps a digital processes

Some thing you should thought initial is the cost of closure towards property, and how enough time it will require to close toward property once this type of prices are satisfied and repaid. These costs, paid off to help you third parties to assist assists new business of an excellent household, usually full 2% to eight% of your home’s purchase price. CoreLogic’s ClosingCorp, a prominent seller from residential home closure pricing study and you can technology towards the home loan and you will home qualities marketplaces, recently wrote a declare that showed an average financial settlement costs to own just one-family unit members possessions were $six,905 in addition to transfer fees and you will $step three,860 excluding import taxes, within the 2021.

Buyers should be wishing that have the way they decide to spend for those even more costs, as well as ought to be conscious that numerous home loan points is help with settlement costs. Va finance, eg, features a limit towards settlement costs, additionally the seller can get safeguards closing costs. Other mortgage products may help safeguards initial will set you back such down payments hence money protected will help safety the expenses for the back end of home loan process. The various version of mortgage activities getting used can all impact how much time it takes to close off to the a house, however, basically maybe not by many days.

Therefore after every condition is purchased, how long does it test romantic towards the a property? Customers should also have a realistic timeframe for how long they takes to close. Domestic lending advantages claim that our home settlement processes normally usually https://paydayloancolorado.net/windsor/ get anywhere from 29 to forty five days to have home ordered having conventional home loan factors. On top of that, whenever you are a money visitors, the method happens smaller given that quicker paperwork try involved.

And exactly how much time will it try personal for the appraisal? The brand new appraisal is bought of the homebuyer and it’s used of the lender to find out if the house may be worth due to the fact far or higher compared to the home loan getting removed. Very homebuyers should be aware of it may get a short while, otherwise often longer, to obtain the assessment accomplished. Even though some technical exists to work on this quickly, never assume all lenders utilize this approach; specific favor sending a skin and blood appraiser into family to obtain their really worth testing and that takes a little stretched.

Certain mortgage loans, instance Va fund, can take a tad longer because tool means a whole lot more papers

Another type of part of closure one to people should think about is how it should do the newest closing: both digitally or perhaps in-person, in the event each other ought not to just take more than a few days in order to prepare the mandatory data having finalizing. Because the pandemic, consumers enjoys increasingly needed electronic mortgage loans an internet-based closings. This 1 can also be permit people so you can sign really data electronically and you can meet myself to help you signal the rest documents that wanted the clear presence of an effective notary otherwise attorney.