Charge and you may Costs

not, of a lot 401(k) agreements charges origination and you can quarterly repair charges, whereas bank loans generally dont. It consolidation normally decreases the appeal of 401(k) money. Specifically, these costs considerably increase the cost of small 401(k) funds.

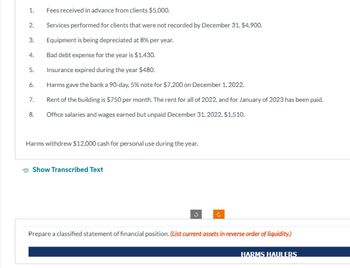

The effect out-of fees into break-even resource get back are presented within the Dining table 4. A great $20,000 loan which have an industry price regarding 7 percent have a good 7.5 percent crack-even financing come back in the event the differences was lead to an excellent 401(k). The break-even drops so you’re able to 6.8 % when the distinction is actually invested in a family savings. In the event that a good $75 origination percentage and you will a beneficial $thirty five yearly fix fee are included, the holiday-also falls so you can 6.3 per cent. Miss the borrowed funds amount to $dos,000 as well as the crack-even drops so you can 2.cuatro per cent. A combination of 401(k) loan fees and small mortgage size significantly decreases the appeal of 401(k) fund. 3

Almost every other Considerations

Deciding whether or not to receive good 401(k) financing pertains to a look at several other advantages and drawbacks related with these funds. 4 Basic, there’s no credit check with 401(k) fund, which makes them more appealing to people that have bad credit. At the same time, people who have poor credit are typically recharged highest interest levels when obtaining a vintage financing; it is not the fact having a 401(k) loan. Another advantage to loans Valley AL help you 401(k) financing is the simplicity. Basically, an initial means is actually submitted to this new employer and you can mortgage payments is deducted on borrower’s income.

A life threatening disadvantage is when an effective 401(k) financing is not paid down, the brand new an excellent amount was claimed on the Internal revenue service while the a delivery together with debtor must pay normal income tax including a 10 % early withdrawal penalty in the event your borrower is younger than age 59?. The potential for default increases if there is jobs loss. Financing out of a great 401(k) should be paid down in full within 90 days just after a position stops, or even the loan is within default. Including, assets in the later years preparations are safe inside the bankruptcy proceeding. People who may deal with bankruptcy will not want to deplete secure property. A great 401(k) mortgage is a terrible selection for some one against a career losses otherwise you’ll bankruptcy.

End

Whenever credit was inescapable, a beneficial 401(k) mortgage may be the most appropriate options not as much as three scenarios. Basic, whether your just alternative are high rate of interest financial obligation, a good 401(k) loan could be the most readily useful solution. A come back to a top interest ecosystem similar to the early 1980s tends to make 401(k) fund more desirable to any or all eligible people. Charge card and other large interest rate debt will make 401(k) fund appealing to someone stuck with the categories of financial obligation. 2nd, an excellent 401(k) mortgage are better if expected funding returns is actually reasonable. For instance, an individual with lower-price fixed-income investments inside the or their particular 401(k) tends to be better off credit the bucks so you can himself/by herself because of a good 401(k) mortgage. 3rd, new 401(k) financing will be the only option if you have poor borrowing otherwise those people who are liquidity limited.

A 401(k) financing isnt the best choice lower than numerous situations. The modern low-value interest environment can make 401(k) fund faster attractive. On top of that, that have a good credit score and you may use of house equity loans allow of numerous in order to borrow in the lower costs that produce 401(k) finance faster aggressive. A 401(k) financing is a poor choice in the event that almost every other lower-price loans can be acquired. A 401(k) financing is also a problematic alternatives when origination and you will repair fees are required and add up to be borrowed are short. In the end, borrowing from the bank outside of a beneficial 401(k) bundle try preferable when financial support production are required to-be large or when borrowers will get remove the jobs otherwise file bankruptcy proceeding.