You might be tempted to pay back their mortgage just as you are able to to lower their monthly premiums and get rid of the personal debt. Yet not, there are many reason you might not have to shell out out of the mortgage. By carrying home financing, you can purchase particular taxation advantages and make use of their most funds to spend toward potential increases that will be more than the financial interest rate. Discover more about exactly why you may not have to repay the financial rapidly.

Interest Payments

By paying off the mortgage very early, you remove their kept desire repayments. And also make costs along the full life of the loan can cost your a significant amount of money. Such as, say you really have an excellent $360,000 mortgage having a thirty-season title and you may a beneficial 3% interest rate, and therefore you can spend $186, during the focus over the longevity of the borrowed funds. For many who pay back that loan more fifteen years at the same rates, you can assess which you are able to shell out $87, into the desire-saving you nearly $100,000.

Your credit rating lies in several facts, including the amount of debt you have got, their payment background, your own credit combine, the length of your credit score, and you can any the brand new credit.

Prospective Losses

If you are using your own more cash to blow, remember that purchasing their loans in the stock exchange doesn’t guarantee returns. You actually have the potential for greater growth, however could also lose cash. And if you are thinking of using money might if you don’t purchase paying off their mortgage, lookup disregard the possibilities carefully and make certain it make together with your risk tolerance level.

Private Monetary Needs

All of us have different economic requires. A loans repayment method that works well for almost all might not really works for other people. People carry out work for a lot more from attaining the financial freedom out-of not responsible for and then make costs to the a home. Instead a home loan, you can retire before or work less period.

A great Debt versus. Crappy Obligations

When you find yourself essentially it’s better to possess no personal debt, particular debt can be considered a lot better than others. Obligations and this can be thought good is personal debt that can help put you into the a far greater budget or helps you make wealth. Such as for instance, college loans shall be a beneficial obligations when they help you get the positioning road and you will earnings that you want. Likewise, a mortgage is an effective obligations where it can help you create a secured asset.

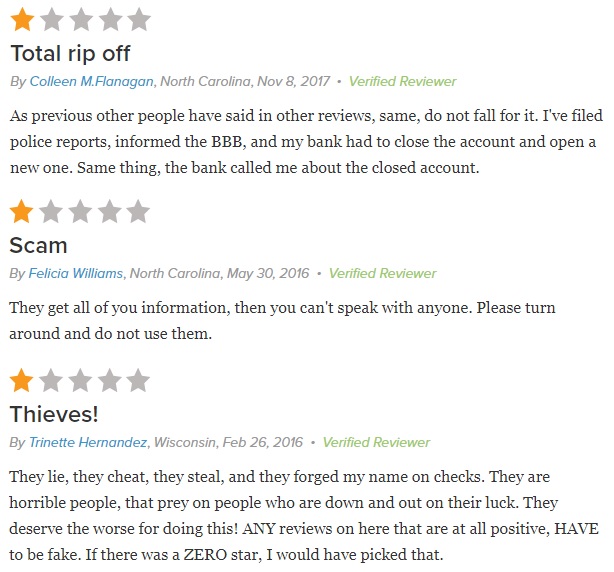

Bad personal debt try obligations that does not work for your financial situation within the the long run. Personal debt with a high rates of interest such as for instance playing cards and payday loan are pricey. Your ount during the appeal rather than strengthening a secured asset.

Can it be a good idea to Shell out My personal Financial Which have a Mastercard?

Some mortgage lenders just make it repayments made from a checking account. Of course, 4000 loan Oak Creek if you actually have the choice and also make a mortgage payment having a credit card, it’s not usually a good idea. You would be investing their home loan interest along with your charge card interest for many who bring a balance out-of few days to day. Which is a pricey home commission you’ll be best off to avoid, if at all possible.

What will happen Once you Repay Your Financial?

Once you pay back their home loan, you will get their mortgage discharge files. This really is authoritative records verifying the loan try paid in complete and you are clearly not any longer responsible for money. Your escrow membership could well be closed, and all most other charges that can come out of that membership have a tendency to end up being your obligations. Including homeowners insurance, possessions taxation, and you will one home owners connection (HOA) charge, in the event the relevant.

What is the Most practical method to pay off Your Mortgage?

You don’t need to put in your a lot more money so you’re able to investing out-of their financial very early. But there are lots of methods for you to increase home loan repayments in the place of diverting out-of most other financial fundamentals.

For-instance, you can make a few most repayments in your home loan from year to year, making certain that those individuals money go to the their dominant harmony, perhaps not your own attention. You are able to bi-month-to-month otherwise weekly repayments, for which you generate mortgage repayments according to should you get your income. This type of commonly grand change, but they makes a change as to what your in the course of time pay when you look at the desire along the longevity of their home loan.

The conclusion

Removing financial obligation can help you change your credit rating and money circulate. Yet not, some debt, eg financial obligations, can be regarded as a beneficial loans as it can certainly help you reach finally your monetary needs.

Take time to completely understand the fresh tradeoffs ranging from paying people obligations early and you will getting that cash for the other uses just before you do thus. Believe consulting a financial mentor to find out more for you to handle loans on the certain condition.