Katie Miller are a customers monetary features pro. She worked for nearly two decades given that a professional, leading multiple-billion dollar financial, bank card, and you may deals profiles having businesses internationally and another work with the user. Their unique financial possibilities try developed article-2008 crisis given that she then followed the significant alter resulting from Dodd-Frank necessary laws.

Starting yet another pond can be a financial investment one to provides your own family many years of athletics and you can fun minutes, but it would be pricey. Before you think a share, it’s a good idea to determine if it makes monetary sense for the items, and if its worthy of exploring pool capital and work out their yard dream possible.

Secret Takeaways

- There are a number of share investment options available, and personal loans and domestic guarantee loans.

- Whenever evaluating pond funding, contrast interest levels and loan terminology to discover the best device to your requirements.

- To safer share money, search lenders, assess your own credit, and you can collect the latest paperwork needed for your application.

- That have a swimming pool get improve the worth of your property by the regarding 7%.

Swimming pool Will cost you

Predicated on HomeAdvisor, the average price of strengthening a swimming pool on your lawn range off $20,000 so you can $100,000, which have a nationwide average from $62,five hundred. Your final price tag depends upon numerous products, including the measurements of this new pond, the sort of information put, plus place.

Above-floor pools is actually much less pricey, having the typical $700$5,000 price tag. While breaking ground, assume it in order to pricing a life threatening five-shape matter. Material-wise, concrete is the most pricey, starting around $fifty,000, nonetheless it lasts new longest. Fiberglass is more affordable features all the way down repairs costs, whenever you are plastic is usually the cheapest but can wanted a lot more servicing.

Additionally, which have a share boasts lingering restoration expenses, that can trust the type of pond. You need to anticipate to funds as much as $80 so you can $150 per month to possess pond maintenance (beginning and closing costs and chemical substances). And additionally, your electric statement will go up of the to $fifty, or higher if https://paydayloancolorado.net/kremmling/ you utilize a pool heating system.

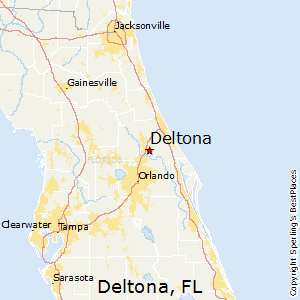

Which have a share can increase the worth of a house from the 5% to eight%. This is certainly highest if you live from inside the a hotter county such as for instance Fl otherwise Tx.

Qualifications Criteria

Whenever you’re thinking about a lending tool, you ought to very first assess your creditworthiness because of the looking at your own credit get. Loan providers usually comment your credit report and want to make certain that you may have constant earnings in order to accept your having a loan.

The greater your credit score, a lot more likely you could qualify for by far the most good attract rate given. When you find yourself which have fight which have credit or no proven money, your loan choice is generally restricted or more high priced.

Interest levels

When money yet another pool, you should get rates out-of multiple loan providers. Large notice will feeling your own payment together with matter you end up paying across the lifetime of the loan. In addition to your borrowing from the bank and you will financial situation, other things that make a difference to interest levels include general economic climates, the quantity your obtain in addition to term of your own mortgage, plus place.

Mortgage Terminology and you may Payment Possibilities

Along the borrowed funds (the mortgage name) and just how your pay back the borrowed funds are important to know once the might impression your financial budget. Extended loan conditions can reduce your invoice, however you will spend additionally the life of one’s mortgage. As for fees options, query on what flexible loan providers was precisely how you pay-off the borrowed funds. As an example, will there be a prepayment punishment? Are there reduced prices for setting-up autopay?