People just who like readvanceable mortgage loans carry out take advantage of financial discipline and you will seemingly large quantities of financial literacy when they to end employing family security to reside beyond their mode, and you will achieve putting aside enough coupons. Fully amortized mortgage loans ensure it is more relaxing for homes with imperfect worry about-manage to store, gather wide range and prepare for old-age. Lookup for the dilemma of home equity borrowing from the bank and you can discounts rates would be beneficial, because there is the chance of HELOCs to aid certain consumers diversify their riches having leveraged funding measures or even increase their discounts through the elimination of its dependence on credit tools with large interest cost (age.g., playing cards).

cuatro.cuatro. Uninformed decision-making

According to research by the business review, problems and you can points claimed to help you FCAC , and you can business surveys, particular customers appear to do not have the information they must generate advised behavior about whether or not to financing their residence orders which have readvanceable mortgage loans. Footnote 16 Economists are finding you to definitely Mortgage can cost you can be found in a great amount of versions, not all of being straightforward to measure. Property remove mortgage loans apparently not often, and frequently negotiate all of them meanwhile that they are undergoing a major lifestyle transition because of the swinging residential property. Under these scenarios, house may don’t build maximum behavior. Footnote 17

The new difficulty off readvanceable mortgages, and you will insufficient focus on the difference between readvanceable and you can antique mortgage loans, could possibly get decelerate consumers’ power to make advised choices. Customers frequently use up all your information regarding loads of accounts. Earliest, certain consumers are unaware of the different charges which are of readvanceable mortgage loans (elizabeth.g., court, assessment, label search, laziness, prepayment and release)plaints obtained from FCAC Individual Services Middle show that users weren’t familiar with specific fees, couldn’t add up of the charges recharged otherwise believed that they had become overcharged.

2nd, customers do not always understand the effects out of hooking up their credit issues in umbrella out-of an excellent readvanceable home loan. Readvanceable mortgages are nearly always secure up against the borrower’s domestic by the a collateral charges, in fact it is more costly to produce than just a normal charges. On the other hand, customers cannot without difficulty option new amortized home loan portion of an effective readvanceable mortgage to a different bank providing a better rates. To change lenders, consumers have to take care of all of the borrowing accounts associated with the newest amortized home loan membership under the umbrella of one’s readvanceable financial. Furthermore, whenever consumers separate the amortized part of its readvanceable financial into the enough sub-accounts with assorted title lengths, they might notice it more challenging and you will expensive to disperse the readvanceable mortgage to another lender.

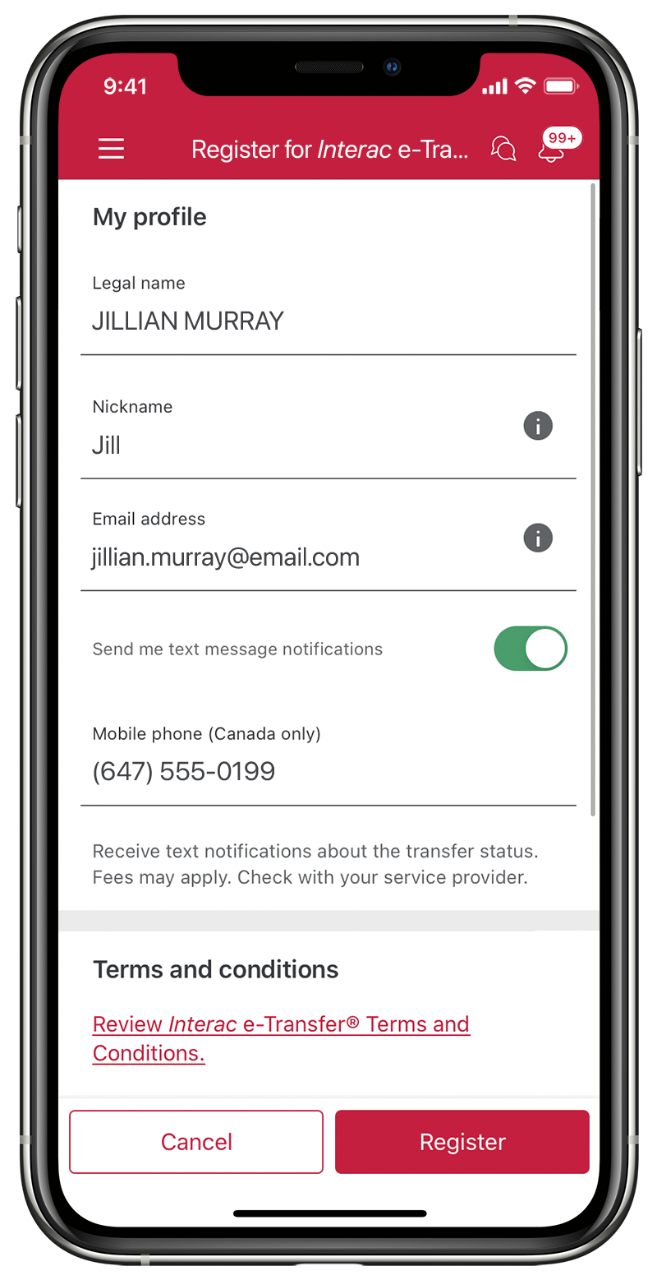

There aren’t any particular regulations stipulating just how loan providers have to divulge the newest conditions and terms out-of HELOCs otherwise readvanceable mortgage loans. Part 10 and Plan 3 of the Price of Credit Laws supply the revelation requirements to possess lines of credit, and HELOCs. Users finding good readvanceable financial can get independent disclosure records for each unit he’s selected. Although not, loan providers aren’t needed to present users that have any particular guidance describing the results away from linking various credit issues less than a beneficial readvanceable home loan. A few lenders offer users that have supplemental situation (age.g., affiliate manuals) to help them understand how readvanceable mortgage loans really works, however the quality of the information presented is inconsistent and the information is limited by technology information (age.grams., simple tips to assess minimum costs).

5. Macroeconomic dangers

Brand new extension of one’s HELOC business might have been an option driver trailing the newest sizeable escalation in family financial obligation inside Canada given that 2000s. Footnote 18 Record levels of debt have increased the new Canadian economy’s susceptability to a longer and a lot more major downturn than just is requested if the house equilibrium sheets were more powerful. Highly in debt home tend to clean out its investing disproportionately more faster with debt domiciles in reaction to help you a financial surprise (elizabeth.g., oils price failure). When a whole lot more seriously https://paydayloanalabama.com/lipscomb/ in financial trouble property scale back, they decreases interest in various consumer products (e.g., vehicles, furniture), which can improve the impression of one’s surprise by curtailing investment and you may broadening unemployment. Footnote 19